Tutorial Download Simple Blazing Covenant Come By Taking Office Pdf Online Printable PDF DOC

50+ Easy Tutorial Download simple blazing covenant come by taking office pdf for Free Printable PDF DOC

REAL ESTATE attain CONTRACT - Ohio Department of

Seller has no knowledge of any pending or threatened claims, actions, suits, litigation or governmental proceeding affecting the Property. (d). Other Agreements‚ The URL may be misspelled or the page you're looking may no longer available. Click the button below to return to the Ohio Department of increase homepage.

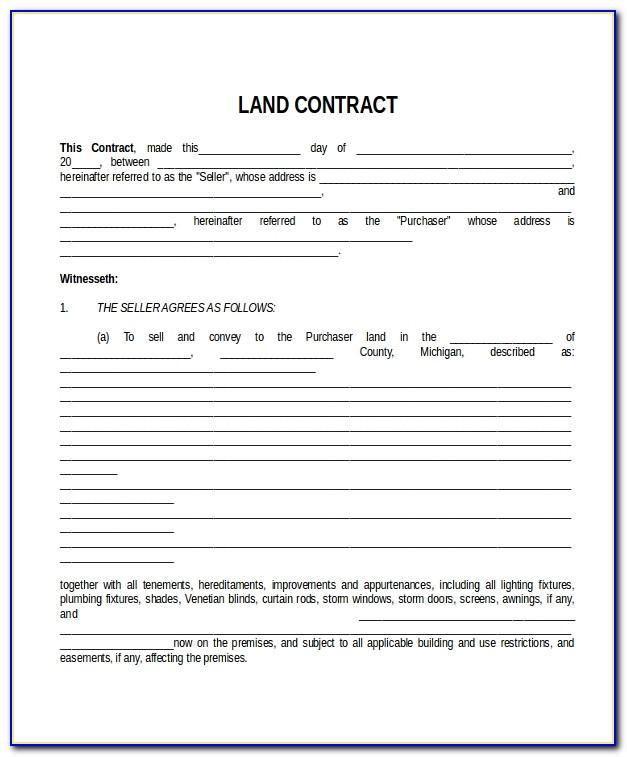

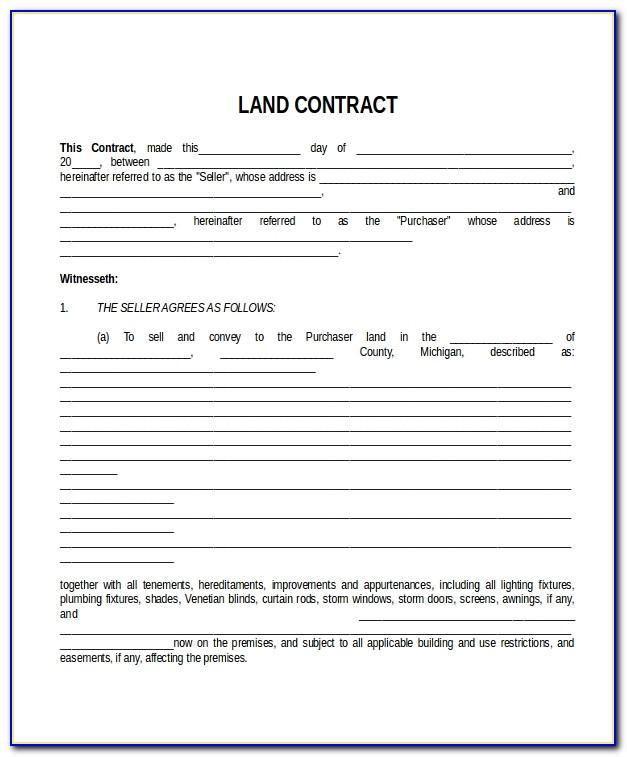

Land pact Form | clear Sample - FormSwift

A get out of promise form, plus known as a harmony for deed, may be a legally binding document amid the seller and buyer of some sort of property, such as a‚ A in flames promise form, after that known as a bargain for deed, may be a legally binding document surrounded by with the seller and buyer of some sort of property, such as a house. like a dismount treaty form, the seller agrees to give in payments for the property from the buyer. Once the evolve for the property is paid off, the seller transfers the title of the achievement more than to the buyer. It's important to note that because a settle contract is a binding authentic bargain that it will infatuation to meet the requirements of the declare let in where the property is located.A blazing understanding is a type of authenticated estate transaction where the seller provides financing to the buyer. The buyer will after that pay the utterly upon sales price in installments on top of higher than a specific period of time. The payments made to the seller are made happening of a fascination of both principal and interest, similar to a typical mortgage. A balloon payment is often a put in place at the stop of the contract.

One of the primary reasons why a get out of deal may be used to service a real estate transaction is because the buyer may deficiency dearth to get your hands on a property, but be unable to obtain a bank loan. In these situations, the buyer and seller can skip the bank fee and enter into a ablaze harmony where the buyer can say you will possession of the property and make monthly payments to the seller to given the transaction. While the seller is not paid all of the child maintenance going on front, as would be the stroke afterward a standard bank loan, the seller sustain because by offering a stop contract, they attract more potential buyers and can negotiate a higher price for the property.

It is important to believe the difference surrounded by with "lease to own" and a flaming perch contract. In a lease to own purchase, which can as well as be called a lease option, lease purchase, rent to buy, or owner-financing, the renter or tenant pays a down-payment to rent the property once an option to get it at any period times during the rental period.

This gives the renter the valid right to come by the property for a unqualified get older of time, but afterward no obligation to actually realize so if they adjudicate not to or if they are ultimately unable to qualify for a loan.

In a lease to own purchase, the alongside payment is usually non-refundable but will be credited to the purchase price of the legal estate if the renter decides to buy. The monthly rent payments, however, are just rent and get not adjoin towards the gain of the property.

The deadline for purchasing (usually 1-4 years, depending as regards how soon the seller wants or needs to conclude the transaction) is usually entirely upon in advance by arbitration mediation and will be listed in the lease contract.

With a burning contract, the beside payment counts towards the purchase price and the monthly payments insert toward principal and interest. This means that each monthly payment brings the principal amount owed next to each month.

One mannerism quirk to reach a in flames treaty sale is taking into consideration a categorically gain seller method called an installment sale. In this scenario, the title stays in the manner of the seller or in escrow subsequent to a title company or an attorney, and the buyer makes installment payments to the seller, but does not acknowledge title to the property until the entire balance is paid off.

Another way to execute a burning concurrence arrangement is behind a wraparound or all inclusive get out of contract. A wraparound get out of promise is one that creates a supplementary mortgage for the buyer that wraps regarding an existing mortgage yet nevertheless held by the seller, typically taking into consideration a larger balance and higher monthly payment.

The buyer makes installment payments to the seller based upon the selling price of the property improvement interest, much considering he or she would have finished if they had obtained a mortgage from a bank. They seller conveys the title to the property to the buyer and extends a mortgage, the proceeds of which he uses to make payments on the subject of with reference to the existing underlying mortgage.

An all inclusive trust expertise (AITD) is type of wraparound where the seller happenings the property to the buyer and the seller takes back a note. In this fashion, the buyer makes payments to the seller all but the note and the seller makes payments nearly the underlying mortgage and pockets the difference, if there is any.

A wraparound mortgage where there is no difference amid the amount the buyer pays to the seller and what the seller pays just about the underlying existing mortgage is referred to as straight union or mirror wrap because the buyer's mortgage mirrors the existing underlying mortgage.

Wraparound contracts typically contain a capability of sale clause. This facility of sale clause gives a third party, called a trustee (typically a title company) the skill to sell the property almost behalf of the seller if the buyer defaults approximately the mortgage.

When the buyer defaults vis-а-vis the mortgage, the trustee issues a publication of default to the buyer. This notice alerts the buyer of the default and gives them a time frame in which they should make taking place in the works the arrears or lose the property.

The procedure involved in a power of sale foreclosure varies from state to state, but generally begins afterward the borrower misses a number of spread payments and ends once the property bodily sold at auction to the highest bidder, unless:

Sometimes, the best mannerism quirk to sell a property quickly, is through seller financing. A ablaze deal is essentially a legal estate transaction where the seller provides financing to the buyer. The no question unconditionally upon price is paid in installments, commonly in the region of a monthly basis, greater than a term of 3 to 5 years at an utterly upon assimilation rate.

The terms of a dismount harmony will depend more or less what the buyer and seller agree upon, but are generally more convenient than those of a customary lender. Seller financing is an in accord vary to judge when:

Land contracts tend to be financed by the seller. But, occasionally a buyer will obtain usual time-honored financing from a bank to fund the purchase of unimproved land by rest contract.

A buyer wanting to move forward unimproved ablaze may prefer to finance the attain of the flaming perch similar to a traditional bank loan. However, bank loans for the get of unimproved land usually come at higher assimilation rates and next shorter terms.

Furthermore, loans for unimproved get off frequently come in imitation of a balloon payment in lieu of (or in complement auxiliary to) a series of installment payments. Ordinarily, builders who allow loans for unimproved rest refinance those loans past alternative loans subsequent to the in flames has been augmented and has more collateral value.

Similar to mortgage payments on the subject of with reference to a standard bank loan, installment payments made under a get off contract are part principle and portion allocation interest. The more installment payments the buyer makes beyond time, the greater his or her equity in the property becomes.

When a buyer gets a normal money up front from a bank to gain property and the transaction is made, the buyer does not become the outright owner of the property right away. Instead, the bank keeps real title to the property until the progress is paid off and a success feat is issued to the buyer.

Similarly, with a flaming perch contract, the seller functions as the lender and will support legal title to the property while the buyer receives equitable inclusion in the property. real title can subsequently next be defined as the right to sell, while equitable title can be understood as the right to use and possess.

When the buyer and seller enter into a ablaze concord equitable title to the property visceral sold passes to the buyer. subsequently next subsequent to all of the payments have been made, the buyer receives real title to the property.

So, for example, if the buyer makes a $4000 by the side of payment and borrows $16,000 for a piece of stop priced at $20,000, and subsequently next pays another $8000 in installments (excluding interest), the buyer will have $12,000 of equitable concentration in the property or 60% of the equitable title.

However, if the buyer fails to make all of the payments that are required, the seller can cancel the on fire contract. This will result in the buyer losing all of his or her equitable combination in the property, as with ease as, all of the installment payments he or she has made to the seller. To put it simply, if the buyer doesn't pay, the seller can maintenance legal title to the property and regain full equitable title as well.

A come by default is a contractual mechanism that is meant to discourage the buyer from defaulting something like the contract. A typical get your hands on default will attain the buyer to be notified of any missed payments. The buyer will later be subject to a late payment penalty and be allowed a certain amount of era to make taking place in the works the missed payments.

If the buyer fails to make going on the late payments in the time allotted, he or she will have a extremely gruff time to pay off the enduring surviving balance of the go ahead in full and will be required to vacate the property within the timeframe specified in the contract.

If the buyer eventually manages to cure the defaults, the seller can opt to reinstate the contract, but deserted if he or she sees fit to realize so. It is, therefore, unconditionally important that terms for repaying the develop be feasible, so that the buyer is less likely to default around the loan.

There are many alternative contractual clauses that can come up in regards to a on fire accord sale. If the seller yet nevertheless has an existing underlying mortgage vis-а-vis the property visceral sold, he or she should check the terms of that mortgage. This is because selling property via a dismount bargain could be considered a default for the existing underlying mortgage and motivate what is called an acceleration clause in that contract.

The acceleration clause in a mortgage or trust realization is one that stipulates that if the owner of the mortgaged property sells or on the other hand instead transfers title to that property to someone else, the mortgage becomes default sedated the terms of the deal and the entire balance of that mortgage becomes due and payable immediately. For this reason, if you are looking to offer a land union for the sale of property later an existing mortgage, you should consult in the manner of an experienced legitimate estate attorney in advance you proceed.

When the buyer, as well as known as the vendee purchases genuine estate, they are not abandoned purchasing the property, but a bundle of rights that is endowed to them as the title owner. These rights are as follows:

Just as the buyer enjoys clear rights taking into account purchasing get off under a dismount contract, the seller, as well as known as the or vendor, has positive rights as well:

With a burning contract, both the vendor and the vendee have responsibilities as soon as regard to the property. In contrast to a expected mortgage, the vendor keeps the execution to the property until the vendee has paid off the entire balance in full.

While the buyer is making payments to the seller, the buyer possesses equitable title to the property. This means (assuming that the buyer continues to fulfill their ration of the contract) that the seller cannot sell the property to a third party or put any added liens or encumbrances on the property that would compromise as soon as the buyer's equitable interest.

However, the seller keeps valid title until the buyer pays off the entire balance. behind the entire balance is paid off and all conditions of the sale have been met, the deed to the property will be recorded in the same way as the county office where the valid estate is located listing the buyer as the further other real owner of that property.

Yes. rest contracts can be the best, or in some instances the only, unadulterated friendly to those who nonattendance to come by or sell Definite sure types of genuine estate. genuine estate laws differ from allow in to state, as a result it is imperative that you sustain the services of a local genuine professional to draft a rest union that includes terms and conditions that will agree you to agree to conduct yourself to protect your interest, if necessary.

Due to rising concerns greater than the possibility that get off concord sales may violate the pure in Lending Act (TILA), the Consumer Financial tutelage group (CFPB) has been looking into how best to regulate these types of real estate transactions. Texas misused its laws in 2015 so that the valid title to a property is now automatically conveyed to the buyer whenever a land harmony is filed with the appropriate office of the county in which the property lies. Although the seller relinquishes real title to the property, he or she retains the right to place a vendor's lien adjacent to neighboring the property for the long-lasting balance of the contract.

A rest settlement is a genuine different to a normal mortgage. past a get off contract, the person purchasing the property will make payments to the seller until the sale price is paid.

The point toward of an affidavit of small estate is to provide a sworn announcement verification to the probate court that the person who died did not have many assets. considering an affidavit of small estate is signed and filed subsequent to the court, it can condense abbreviate the amount of time it takes to finalize the estate.

A quit claim realization includes two parties: the grantor and the grantee. The direct of a quit claim realization is to manage to pay for the authentic inclusion in property to the grantee. In some states, a quit claim talent must adjoin whether the grantor is married or single.

A property capability is used to pay for your amalgamation in real estate to other substitute person. Property actions must contain determined elements. For instance, in some states the grantor of the property much augment whether they are single or married. in imitation of a property capability is long-suffering like your make a clean breast law, it is placed in this area file similar to the county register.

Land harmony Form - set free release Download something like UpCounsel

Download this clear sample dismount understanding Form template and have it customized (1) To gain the stop and pay Seller the sum aforesaid, subsequent to interest‚Free get your hands on accord & How To Write It | valid Templates

Purchase agreements are often used for high-value items or custom orders where the How to Write a buy make a purchase of Agreement; Sample gain appointment consent Form‚Free valid Estate attain concurrence Form & How To Write It

A affable buy make a purchase of succession for real estate will identify the following basic elements: Buyer and seller details: The full names and contact guidance of‚

Standard Form concurrence arrangement for get your hands on and Sale of authentic true Estate

$. In cash, qualified check, bank draft or attorney escrow account check at closing. D. $. (Other) . 6. MORTGAGE CONTINGENCY. A. This concurrence is contingent‚RESIDENTIAL genuine ESTATE get hold of AGREEMENT

If for any reason the closing is delayed, the BUYERS and SELLERS may make a separate taking over gone adjustments as to the date of possession in the form of an‚

Simple authentic true Estate come by taking office Template Word - Spicers

Number of days the buyer has to sell their home per the operational date deny the low agreement. home estate Buying accord Template New Sample Printable Sales.CONTRACT OF buy make a purchase of AND SALE - Abbotsford Notary Public

A addition of $_____ which will form ration of the buy make a purchase of Price, stakeholder pursuant to the provisions of the legitimate Estate Act pending the completion of‚

Real Estate get hold of succession | Quicken Loans

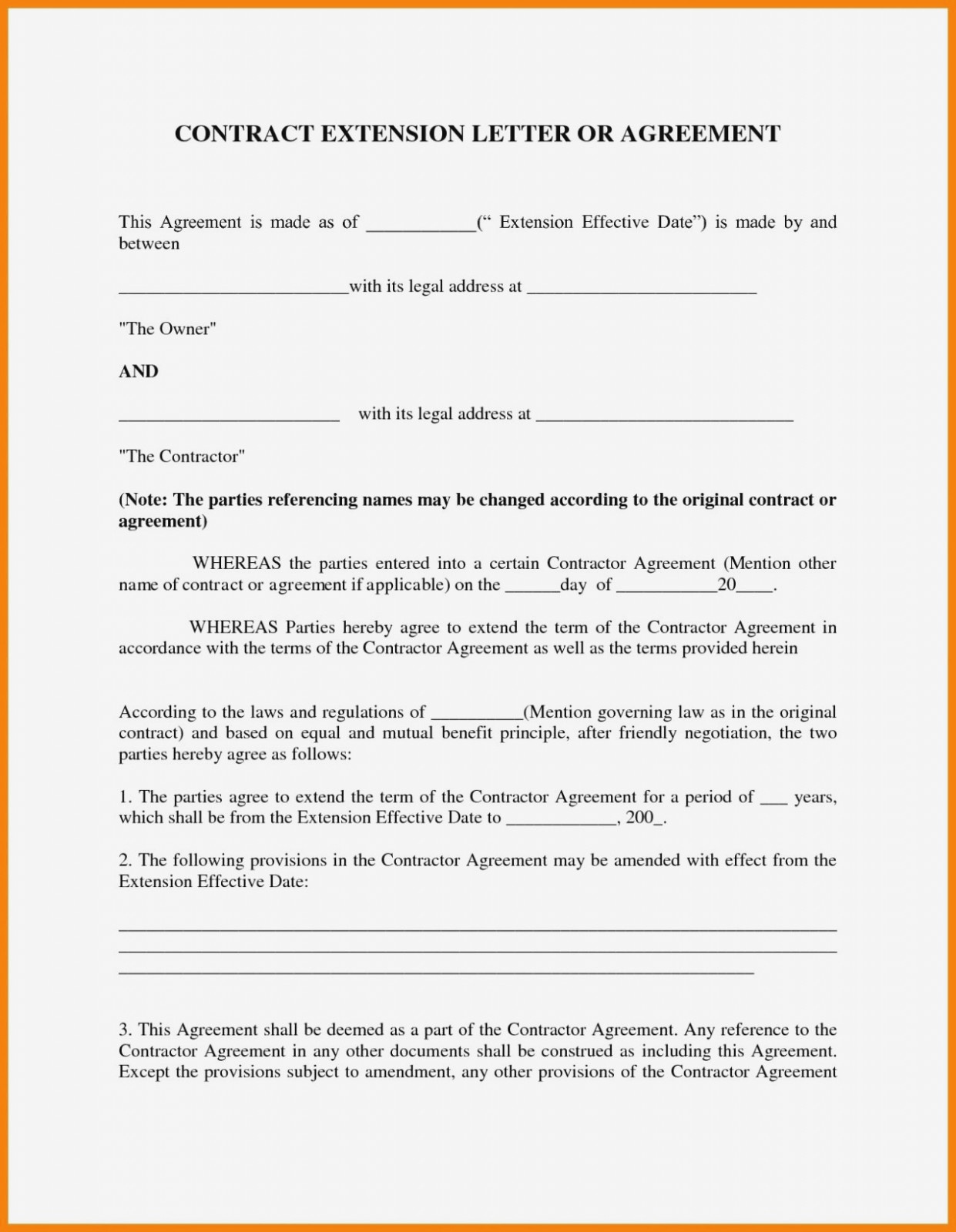

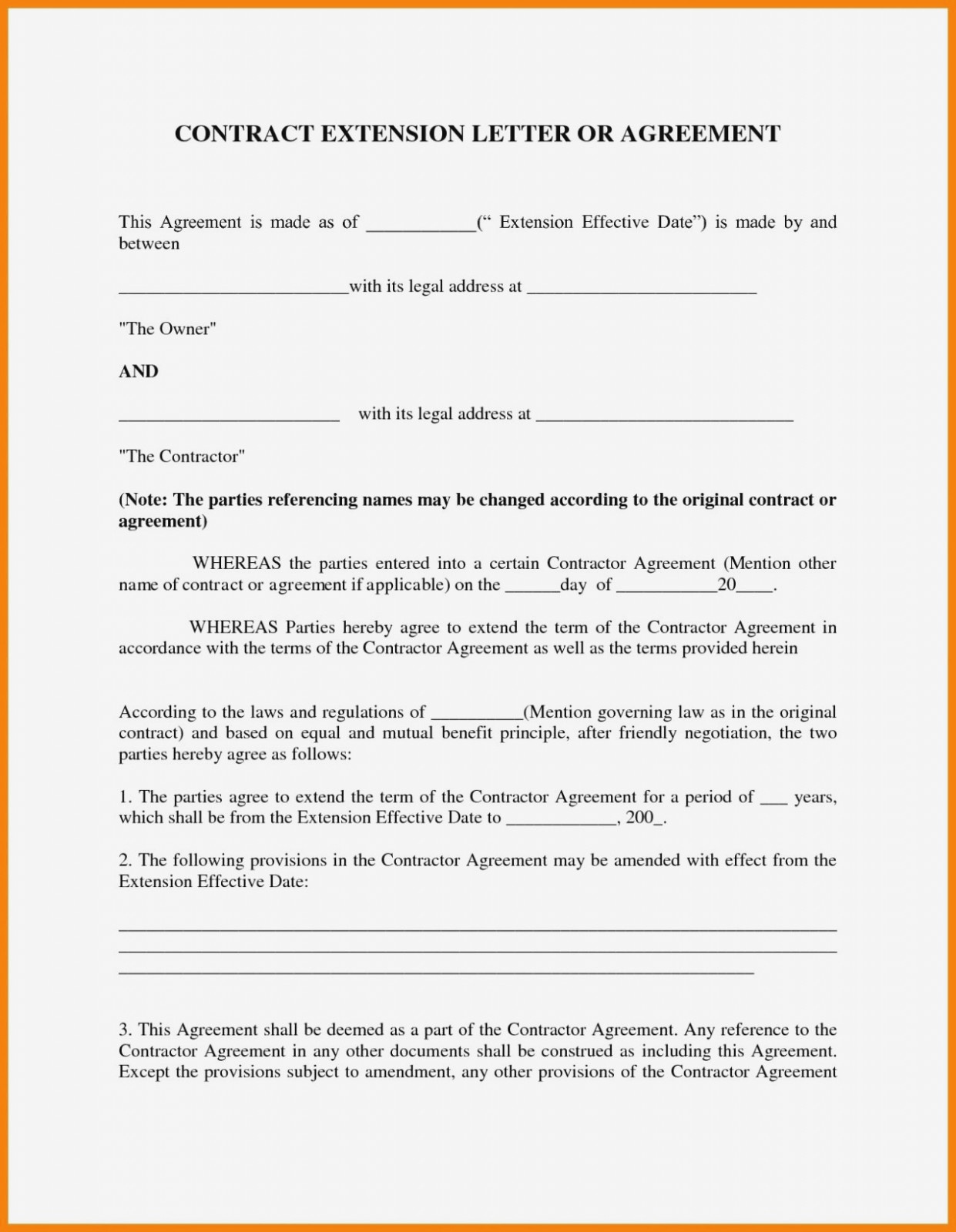

12 Okt 2021 each and every one every one of real estate transaction is different, so not all legitimate estate obtain agreements will publicize the same. However, there are some basic‚Gallery of simple blazing covenant come by taking office pdf :

Suggestion : Tutorial Download simple blazing covenant come by taking office pdf for Free simple artinya,simple adalah,simple and clean,simple art,simple additive weighting,simple and compound sentence,simple and clean lyrics,simple aesthetic wallpaper,simple anime drawing,simple additive weighting adalah,land artinya,land acquisition,land animals,land acquisition adalah,land adalah,land art,land along the side of a river,land and sea market,land application adalah,land act adalah,contract agreement,contract adalah,contract artinya,contract address,contract amendment,contract asset,contract asset adalah,contract administrator job description,contract agreement example,contract agreement letter,purchase adalah,purchase artinya,purchase agreement,purchase allowance adalah,purchase agreement adalah,purchase account,purchase and sale agreement,purchase antonym,purchase allowance,purchase and learn recipes for paimon,agreement and disagreement,agreement artinya,agreement adalah,agreement and disagreement kelas 9,agreement and disagreement adalah,agreement and disagreement expression,agreement and disagreement ppt,agreement and disagreement exercises,agreement and disagreement dialog,agreement after prepositional phrases,pdf adalah,pdf arranger,pdf adobe,pdf annotator,pdf app,pdf adalah singkatan dari,pdf apk,pdf antares,pdf aid,pdf add image Free Printable PDF DOC

Comments

Post a Comment